Still recovering from the pain of the 2007-2009 market drawdown? By J Thomas Knight, CFP®, CPA

Market drawdowns are like experiencing a major injury. The initial pain can be debilitating, but the on-going “torture” of recovery or physical therapy can be more than discouraging. Investment losses and market drawdowns are reductions to your wealth and have a recovery period which can delay, damage, and even destroy dreams. The pain and recovery of a drawdown is deflating and here is why:

A market drawdown is a decline from the highest high (Peak) to the lowest low (Trough), and usually occurs quickly compared to the time it takes to recover.

A market drawdown is a decline from the highest high (Peak) to the lowest low (Trough), and usually occurs quickly compared to the time it takes to recover.

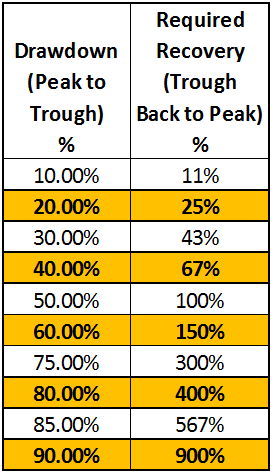

A 10% drawdown, requires an 11% return to recoup the loss. It requires a larger percent return to recover a loss than the percent loss it took to lose it. Needing 11% to rise from a 10% loss may not seem like much of a difference, but keep reading the chart.

A 50% drawdown requires a 100% return to recover!

How long does it take to earn a 100% return? 6, 8, 10 years or more?

A 90% drawdown requires a 900% return to be whole again!

But that’s crazy talk, right? After all, when does a 50% loss happen? Let’s get real.

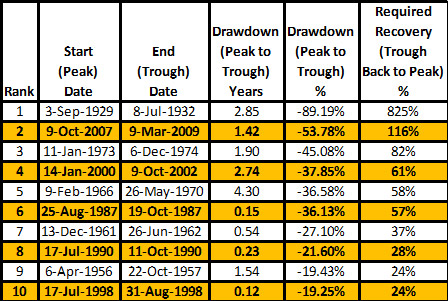

Shockingly, a 53% loss hit us as recently as October 2007 through March 2009.

Ok then it’s absolutely crazy to think a 90% loss will occur. When has that ever happened?

Crack open the history books…1929 when 89% evaporated in less than 3 years!

It can happen again. In fact, there are plenty of examples of damaging drawdowns.

Here are the Top 10 drawdowns since 1928.

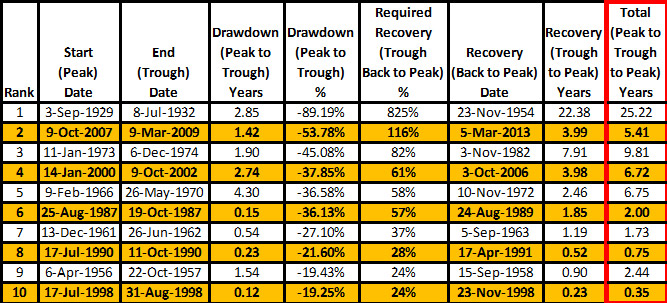

As evidenceded, drawdowns are devastating to your dreams, but that is only half the story. Drawdowns are Peak to Trough, what about climbing out of from the Trough back to the Peak? How long does that take? That depends on how well you do your physical therapy. That is what a drawdown is like…suffer the loss and endure the recovery. Both sides are undesirable, so be careful.

As evidenceded, drawdowns are devastating to your dreams, but that is only half the story. Drawdowns are Peak to Trough, what about climbing out of from the Trough back to the Peak? How long does that take? That depends on how well you do your physical therapy. That is what a drawdown is like…suffer the loss and endure the recovery. Both sides are undesirable, so be careful.

Just ONE drawdown in your life can absolutely devastate your portfolio for years!

Experiencing a drawdown is bad enough, but the rehabilitation can be equally as painful.

Examine those numbers closely. They are frightening – years upon years to recover. The total time from injury to full recovery (Peak to Trough back to Peak) is even scarier. Volatility, especially volatility of this nature, is the primary component of suffering and stricken portfolios.

If you had been investing since January 1, 1973, then more than 25 of those 40 years would have been in “pain or recovery.” Think about that…as of March 6, 2013, more than 62% of your investment years were spent losing money or trying to recover from a loss. The Dow just peaked again in March 2013; it took 4 years from the March 2009 trough to climb out of a drawdown that lasted less than 1.5 years.

If 62% of your personal life was spent being injured or in physical therapy, would you not protect yourself better? Unfortunately, most managers will continue with pain & recovery through a strategy of “Buy & Hold.” This is a strategy where you invest with an appropriate asset allocation, rebalance periodically, and hold on for years. The theory is that diversification and allocation dampens volatility while the market, on average, will continue to rise. In 2007, correlation caused the majority of investors to experience tremendous losses despite their diversification and allocation. It really should be renamed in a more honest fashion, something like “Buy & Hold through Recovery after Recovery.”

If you are buying & holding mutual funds, then you are really not buying & holding. The mutual fund manager is trading earnestly to Buy Low and Sell High. This is why you receive a 1099-form from the mutual fund company, even in down years. The mutual fund manager has a problem, they are required by their charter or fund objective (found in their prospectus) to maintain a certain amount in the market…usually 80%. As a result, a majority of mutual fund managers have limited control over their market exposure; therefore, despite all their information, knowledge, and education these brilliant and well staffed money managers are NOT permitted to exit the market even if they wanted to do so.

Given the disturbing nature of drawdowns, we at Winston Paul believe it makes perfect sense to defend against drawdowns/losses and deploy capital when the market indicates it is around a low point.

By defending against losses, more of your principal remains intact. More corpus means a lesser return is needed to succeed, which means less risk is taken, which means less volatility is in your portfolio.

Example: A 10% return on $750,000 is better than a 12% return on $600,000; $75,000 > $72,000.

The reason you have $750,000, and not $600,000, is because you were defending against losses.

In this example, 10% is better than 12% and of course $750,000 is greater than $600,000.

By avoiding most of a drawdown and capturing most of an up-market, your portfolio will have less volatility and be further ahead compared to a Buy & Hold strategy. We defend against market drawdowns and capture gains through our trademarked investment program, DEFEND & Deploy®.

Competitors try to cast our program in a negative light and label it as market timing, but we are simply doing what mutual fund managers do, what active managers do, and are doing what you naturally want us to do – Buy Low and Sell High to protect and grow your assets.

Which is for you, the strategy of “Buy & Hold through Recovery after Recovery” or a program of DEFEND & Deploy®? Will we be perfect? No, but we put the odds of success back in your favor.